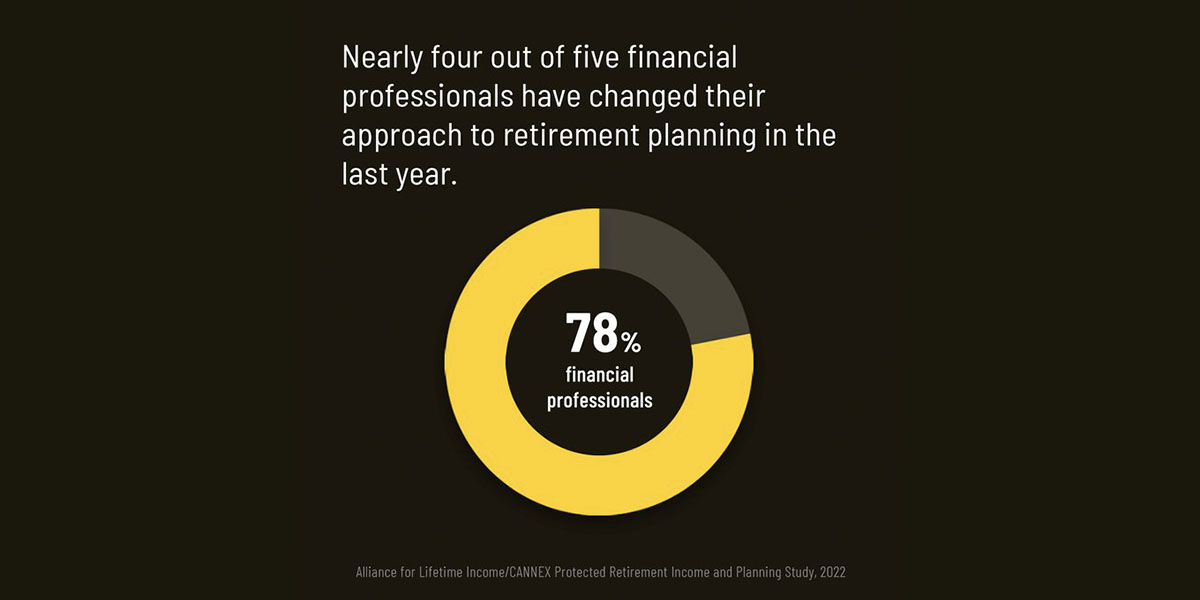

We worked with our partners at the Alliance for Lifetime Income and CANNEX on the recently released third installment of the Protected Retirement Income and Planning [PRIP] Study, a joint research effort focused on both investors and financial professionals, designed to better understand and forecast retirement income trends.

The findings from this most recent study are tied to the current market environment, with high inflation and recession anxieties as notable concerns.

Top insights include the following:

- Americans are worried about the dual impact of high inflation reducing spending power in retirement (81%) and a recession impacting retirement income (79%).

- Registered investment advisors and broker-dealers are even more concerned than consumers about inflation, market volatility and chances of a recession.

- Anxiety about inflation is manifesting in real-world behaviors: 6 in 10 consumers reported reducing their spending.

- 1 in 3 financial professionals are more likely to recommend an annuity due to rising interest rates, inflation and growing anxiety.

Learn more in this research summary [PDF] and dig into insights from the first two studies on the PRIP landing page.