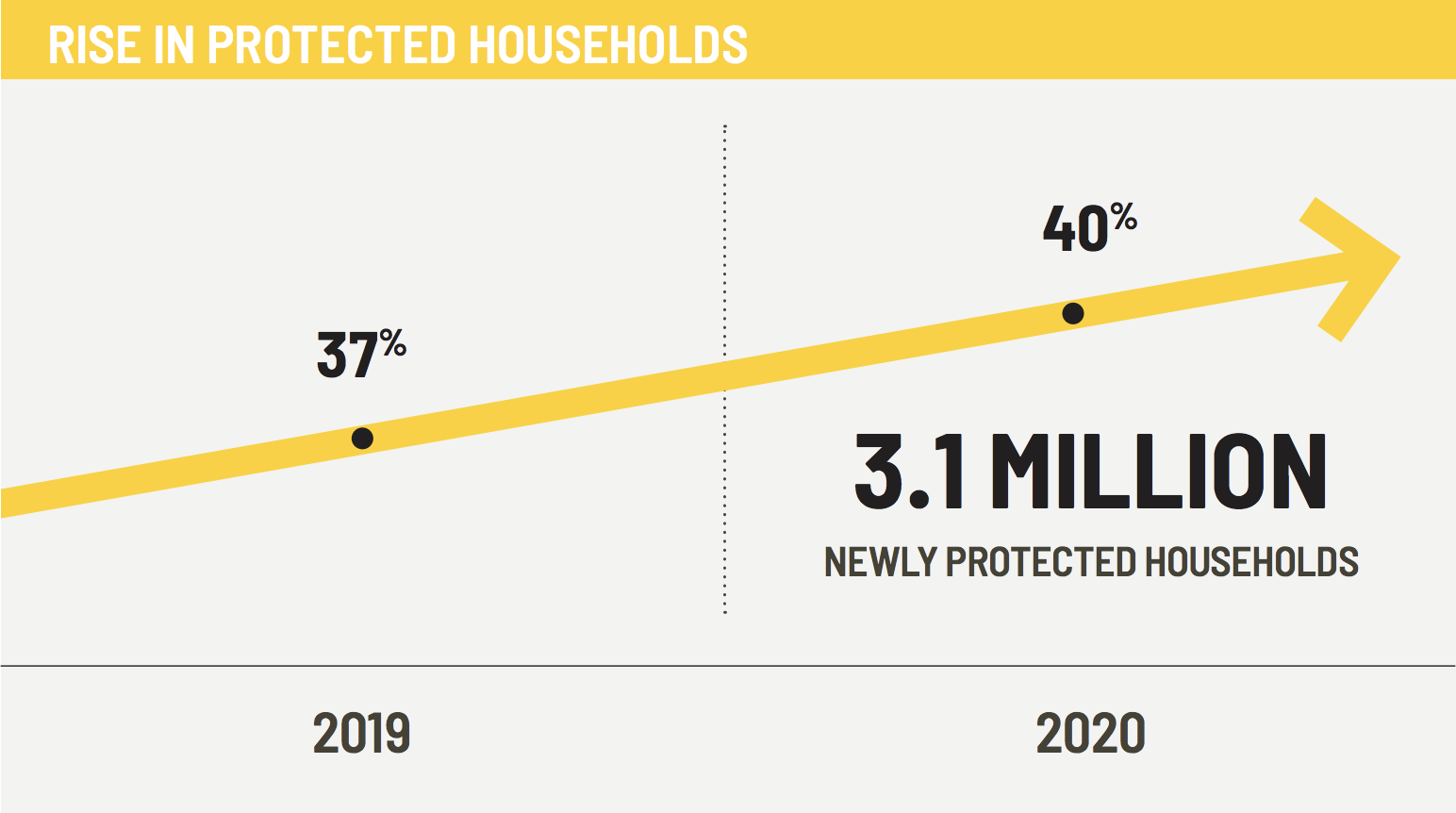

Our client the Alliance for Lifetime Income (ALI) recently published results from a nationwide survey that spotlights some of the progress and inherent tensions facing Americans thinking about, planning for and living in retirement. In conducting this survey, we found that an estimated 3.1 million households added a source of protected income in the past year. We also introduce five profiles of Americans planning for retirement.

Other key takeaways include the following:

- People are more anxious about retirement due to the COVID-19 pandemic, but optimism prevails — especially for those with protected income. Americans with a source of protected income in addition to Social Security are significantly more confident about their retirement income. Among protected households, 78% expect their income to last their lifetime, versus 41% of those who are unprotected.

- Americans like the benefits of annuities, but more education is needed to help people create retirement portfolios built to generate both probable and protected income in retirement.

- The five profiles of Americans planning for retirement provide a behavioral and emotional road map. These profiles aim to help both financial professionals better understand how they can serve their clients, and Americans better understand their own attitudes, goals and process in preparing for retirement.

This online study was conducted in August 2020 among a Census-balanced cross-section of 3,036 U.S. adults ages 25-74. Study results were weighted to correspond to the distribution of the U.S. adult population based on age, gender, income, race, education, ethnicity and region.

View the press release on the Alliance for Lifetime Income website and explore the data in this PDF summary.

Previous ALI Protected Income Studies

Three previous studies, known as the COVID-19 Retirement Reset Trackers, were conducted by ALI during the pandemic. The first, conducted in early to mid-March, assessed the impact of market volatility on retirement for those in their prime retirement years – ages 61 to 65. The second, conducted in April using a cohort with the same demographics as this third study, found that more older Americans are looking to reduce retirement risk due to the COVID-19 pandemic. The final wave, conducted in June, found that COVID-19 and the subsequent market volatility are making Americans more pessimistic about their retirement plans and driving many to seek lower-risk options for their retirement investments. For a refresher on the context during which this studies were fielded, please see the chart below.