Our client the Alliance for Lifetime Income (ALI) recently published results from a nationwide survey of people in their prime retirement years – ages 61 to 65 – to better understand the questions, lessons and surprises that arise for so many as they approach the end of their career. This survey was conducted during a period of massive upheaval and market volatility (March 6-16) from the initial impact of the coronavirus and resulting economic uncertainty. It therefore provided useful insights into how Americans at this age respond to heightened uncertainty and think about the timing of their own retirement.

Key takeaways include the following:

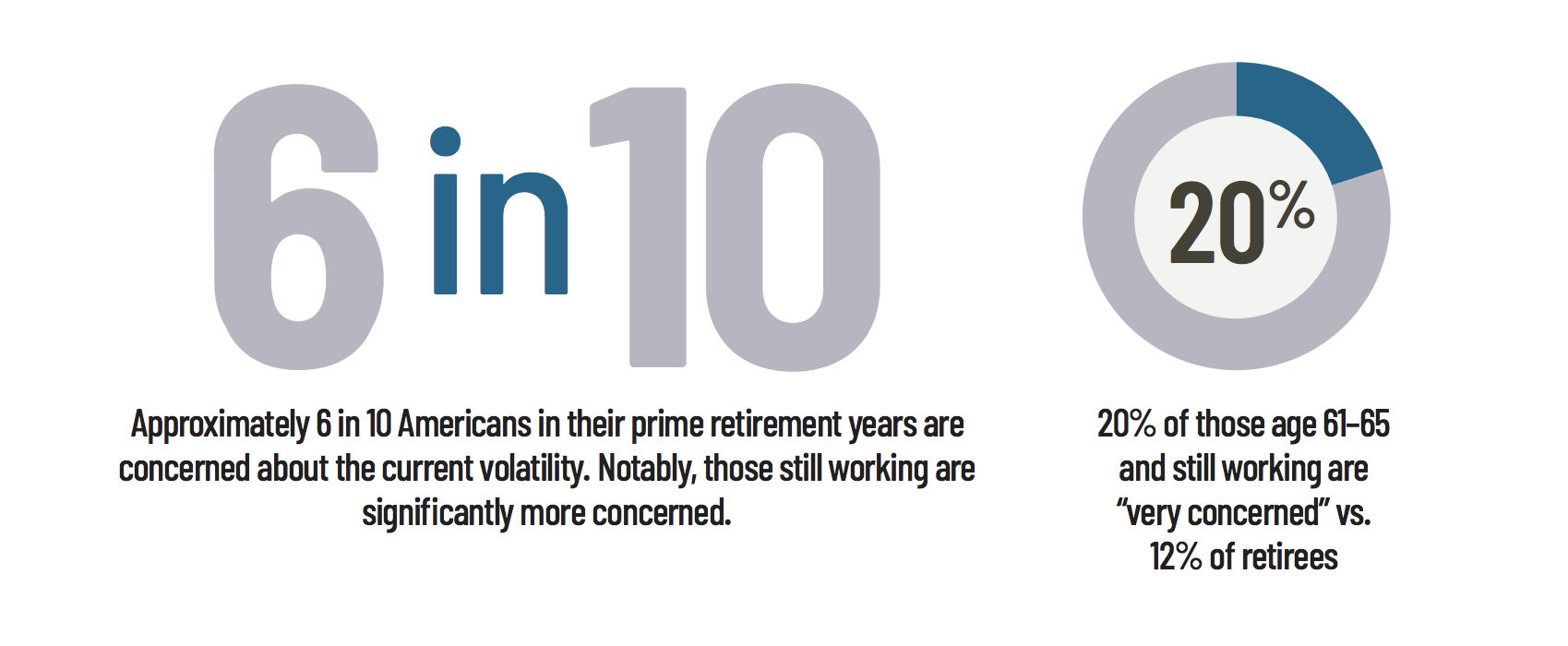

- Six out of ten people expressed concern about the significant market volatility we’ve experienced in recent weeks, and the level of concern is even higher among those still working and nearing retirement.

- More than seven out of ten people in their prime retirement years aren’t making changes to their portfolio; this number is mirrored by the 76% of people who reported having a pension, annuity or both.

- Among those who are currently employed, more than half (52%) are not fully confident they’ll be able to retire at the age they identify as their goal. Stock market conditions were most often pointed to as the reason for that uncertainty.

Learn more on the Protected Lifetime Income website, view the press release on the Alliance for Lifetime Income website, and explore the data in this PDF fact sheet.