Initial findings from the 2016 Artemis Motivations Assessment Program™ (MAP) include the following on Americans’ health and financial wellbeing:

- Confidence about health far exceeds financial confidence

- Health and finance decisions both produce anxiety

Most people strive for good health and financial wellbeing throughout their adult lives, the pair acting as two of life’s greatest motivators. Often, they are inextricably intertwined. Pundits through the centuries, from Virgil (“The greatest wealth is health”) to Ralph Waldo Emerson (“The first wealth is health”) to various modern day commentators (a recent favorite: “So many people spend their health gaining wealth, and then have to spend their wealth regaining their health”), have had something to say about this connection.

What forces drive Americans’ health and financial decisions, and what’s the nature of this connection? The 2016 Artemis Motivations Assessment Program (MAP) applies our Motivation Research approach through a large quantitative survey, with respondents representing a diverse cross-section of America, to answer these questions. The approach begins with a framing of health and financial goals; catalogues the actions that individuals take in pursuit of those goals as well as the barriers that get in the way; then connects to the benefits and emotional motivators that underlie decisions. This process provides us with insights into the landscape of health and financial decisions, and how those two realms intersect.

The first question we wanted to answer was, “How do Americans feel overall about their health and financial status?” Our findings reveal something about where we’re starting from, and perhaps are a reflection of the current dynamics of our society.

Health wins

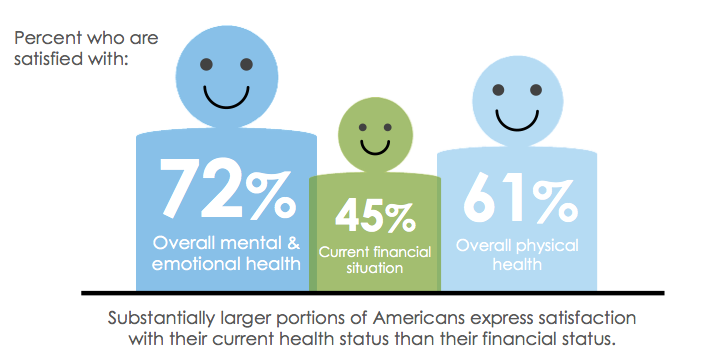

By a substantial margin, Americans are happier about the state of their health than they are about their financial wellbeing. Substantially larger portions of Americans express satisfaction with their current health status than their financial status.

Money isn’t everything

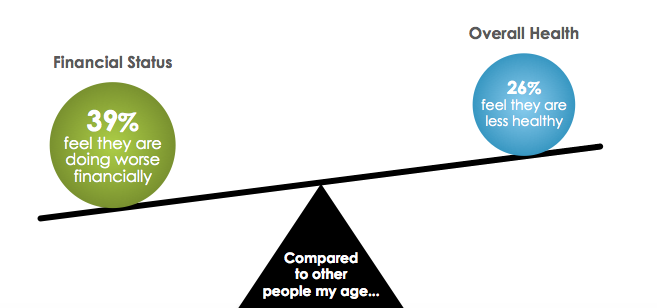

One way that we as human beings gauge our own status is by comparing to others. When we ask Americans how their health and financial status stacks up against others their age (the simplest of peer comparisons), the contrast in health and financial perceptions is enlightening. Americans are significantly more likely to rate their financial situation worse than their peers while rating their health better than average.

This finding, all by itself, is worth an investigation. What’s going on when people look at their peers and feel better about their relative health than about their relative financial status?

Personal control

One giant clue is that, on average, people feel less anxious and more in control of their personal health than their financial health. What drives this sense of control? It’s not the amount of effort that people expend. When we ask, the substantial majority of Americans indicate that they devote considerable effort to both their health and their financial wellbeing. In fact, they report devoting slightly more effort on average to their financial affairs than to their health.

More likely it has to do with the proximity of the actions people can take, their support structure and the prominence of external barriers to success. In prior (2013) MAP research we observed that people are far more likely to report that their health decisions are influenced by health professionals than is the case with financial affairs, where professionals are seen as a much less influential group. In research on retirement planning Ameriprise reported that for many pre-retirees their strategy for affording health care costs in retirement is based considerably on maintaining their good health, conveying that people feel it is easier to take those actions than to generate more financial resources.

Easy for you to say

Averages paint an interesting picture, but they hide so much of the dynamic within each of these sets of life decisions. We know from MAP that within both the financial and health realms there are many anxiety-inducing forces at work (see the summary of Neal Gabler’s Atlantic Monthly confession in our Trends Series post on “America’s Financial Insecurity” as well as our post on “Health Information Overload”). Considerable portions of the population struggle not to be overwhelmed.

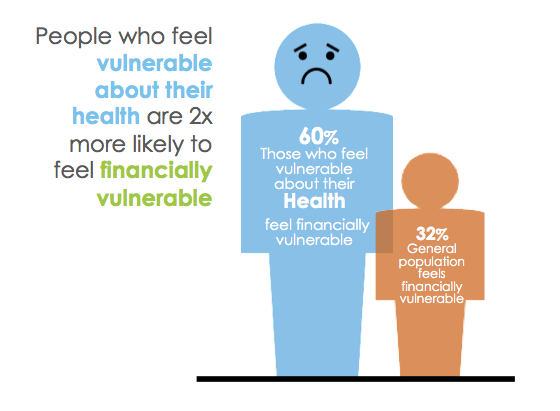

We also see that there are powerful connections between health and financial decisions. Some are tied to the natural progression: as people age they usually accumulate more financial resources while encountering more health surprises. Beyond that, the connection between physical and financial health is powerful; people who have more health problems are significantly more likely to have financial issues, and vice versa.

Just one statistic from this MAP analysis helps characterize the scale of this phenomenon: people feeling overwhelmed by their health situation are nearly twice as likely to be overwhelmed by their financial situation.

We’ll outline some of the details around this relationship in our next blog post.

What’s the starting point for health and financial wellbeing?

The decisions people make depend on where they think they are and what they want or need to accomplish. Both health and financial wellbeing involve complex mixes of activities, as well as floods of information to digest and decisions to make. The average American has multiple health and financial goals they are trying to achieve.

Look for more insights on Americans’ goals in subsequent blog posts to be posted later this month. They’ll each explore a facet of the landscape of our society’s health and financial decision-making.