The first wealth is health.

– Ralph Waldo Emerson

The intersection between Americans’ health and wealth is intuitive. Some companies are beginning to offer products, services and employee benefits to meet the needs that arise from this convergence. We believe there is opportunity to explore even more solutions that will help Americans become more at peace with their health and wealth, and to help companies grow and become more profitable at the same time.

As the Urban Institute describes in their study How Are Income and Wealth Linked to Health and Longevity [PDF], focusing on improving health and wealth has broad implications. Effective advancements would be a boon for the productivity and healthcare costs of American businesses, controlling the soaring costs of health care systems and a myriad of policy efforts, including education, economic opportunity, transportation and housing.

Using Motivation Research to determine how health and wealth impact peace of mind

The goal of our Motivation Research approach is to understand the emotional drivers behind specific decisions. The personal values framework we use focuses on understanding the values people strive toward in any and all aspects of their lives. Thanks to years of conducting this type of research, we know that “peace of mind” is an overarching value shared across most life experiences of Americans.

In our most recent MAPTM study, an online survey of a census-balanced sample of 1000 adult Americans, we examined how people assess their financial and physical wellness. We asked respondents, “When thinking about your current health, to what degree do you have a sense of peace of mind, meaning most things are in good shape regarding your health?” Then we asked the same question about their financial situation.

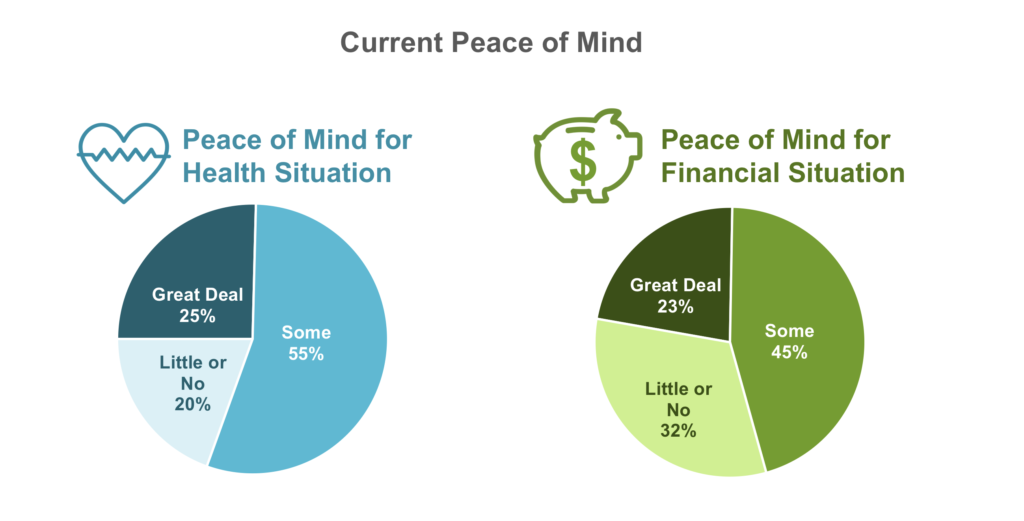

About a quarter of Americans have a great deal of peace of mind about one or the other. However, more feel better about their health situation overall than their financial situation:

The tilt toward more satisfaction about one’s health circumstances than financial is consistent with findings from our previous MAP studies. We’ve found that people evaluate their health more directly based on how they look and feel. Our hypothesis: Financial health is not a feeling; Americans measure it as an external state. While the emotions people feel about their health and wealth are similar (confidence, control, worry, fear) the metrics they use to evaluate their wealth are external (e.g., bank statements), yet a mix of external (e.g., blood pressure readings) and internal (e.g., pain) for their health.

The intersection of health and wealth peace of mind

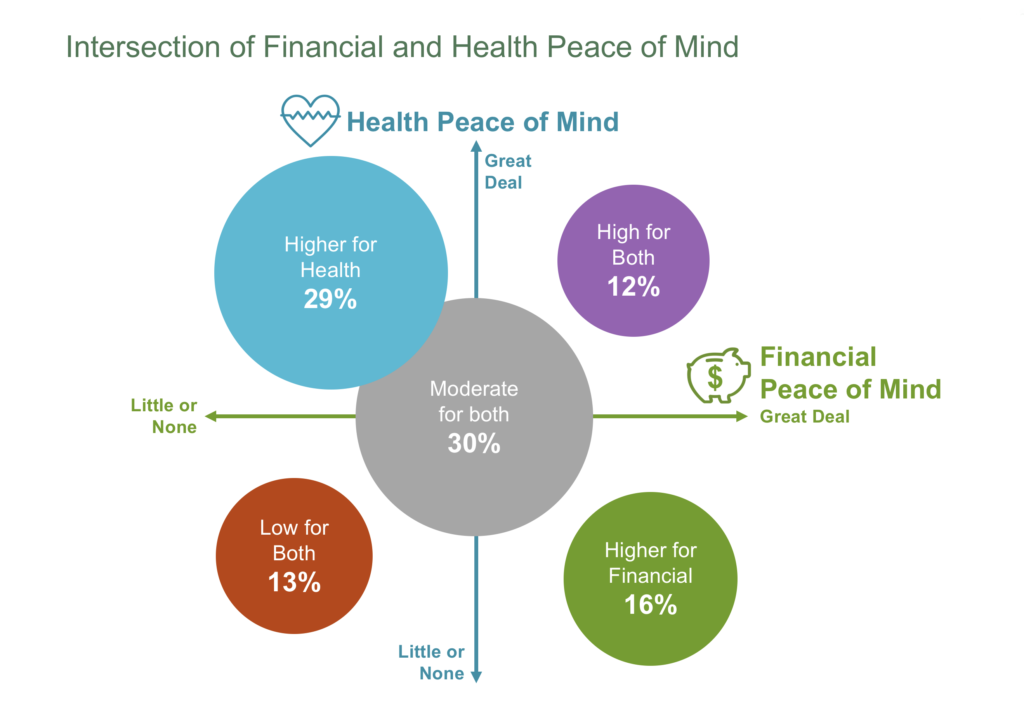

Our analysis shows the powerful intersection between Americans’ financial and health peace of mind. The chart below illustrates that 12% of Americans have a great deal of peace of mind about both their health and financial states (pictured in the upper right quadrant), while 13% have low peace of mind for both (pictured in the lower left quadrant). Three out of ten are moderate for both.

At a high level, we can see several things. First, those who have the highest peace of mind (the 12% depicted in purple above) tend to feel relaxed, confident and in control of both their health and wealth. They have the lowest reported levels of financial anxiety. They are highly engaged and motivated to take care of their health and wealth.

Next, those with lowest peace of mind about both health and wealth (the 13% depicted in red) tend to feel high levels of insecurity and a sense of being out of control in both dimensions – which is compounded by high levels of anxiety. They have the lowest levels of income and saving and the highest levels of debt. More are unemployed or disabled. Fewer have families. They are more focused on managing chronic medical conditions or improving mental and emotional health. They are working to stabilize their finances to make ends meet or recovering from major setbacks.

The impact of employee benefits on health and wealth

In our low-unemployment-rate economy, the competition for good talent is fierce. Employee benefits are a strong consideration for both acquisition and retention of employees.

While our 2019 MAP analysis focused on how people think about their health, we also looked at the connections between health, finances and the influencers (e.g., government policy and employers) that impact those aspects of people’s lives. [See our two recently published white papers on this research: Health and Finances: Americans’ Views on Government Priorities [PDF] and Becoming Healthy, Wealthy and Wise. Can an App Do All That? [PDF].] We examined how directly Americans see their employer wellness programs and benefits as contributing to personal health or financial well-being.

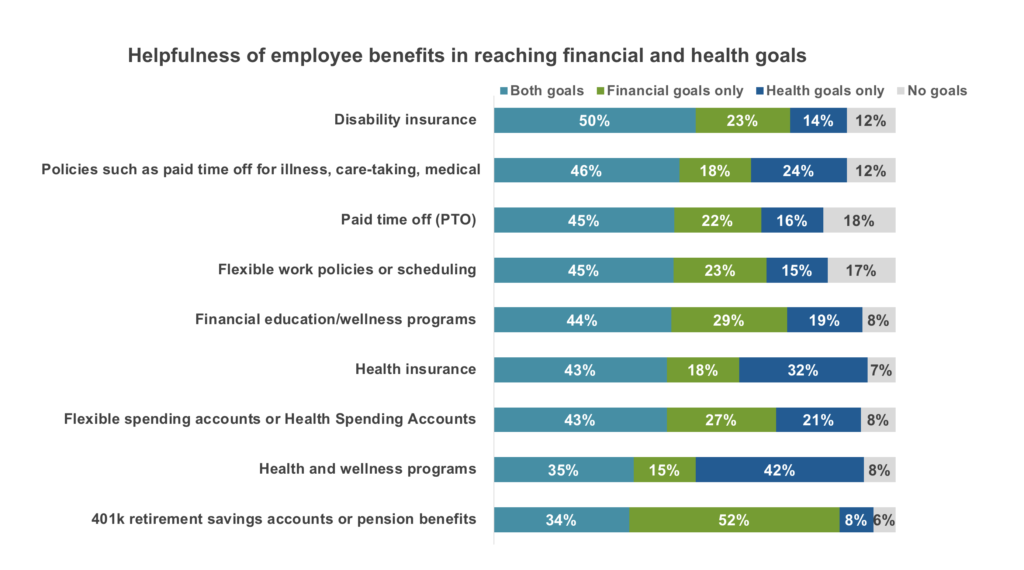

Employers are in a unique position to help their employees achieve health and financial wellness through the benefits they offer. The chart below shows the top nine benefits that employees receive today. Each of these benefits has different levels of penetration; this chart shows how employees view each of the benefits that they have and use. Most striking: The majority of employees see these benefits as serving both their financial and health needs.

Who is getting it right?

We like what Prudential is doing. They have tracked the link between financial well-being and personal well-being for years. Based on their findings they changed their employee benefits program and focused on both sides of the equation. They implemented initiatives such as budget coaching, healthcare plan design changes and changes to retirement plans. The result was a significant decrease in their workforce of those who felt financially stressed.

Health and wealth are inextricably linked. Their connection goes beyond the direct and tangible, extending into emotional decision drivers and fundamental personal values. Smart marketers will learn how to connect emotionally laden life circumstances like health and wealth with their products and services in ways that can satisfy Americans’ needs, their own organization’s needs, and perhaps even meet broader societal needs.