Our client the Alliance for Lifetime Income (ALI) recently published results from the inaugural Protected Retirement Income and Planning (PRIP) study. In analyzing them, we found important generational differences and increasing consumer demand for protected income.

Some of the study’s key takeaways include:

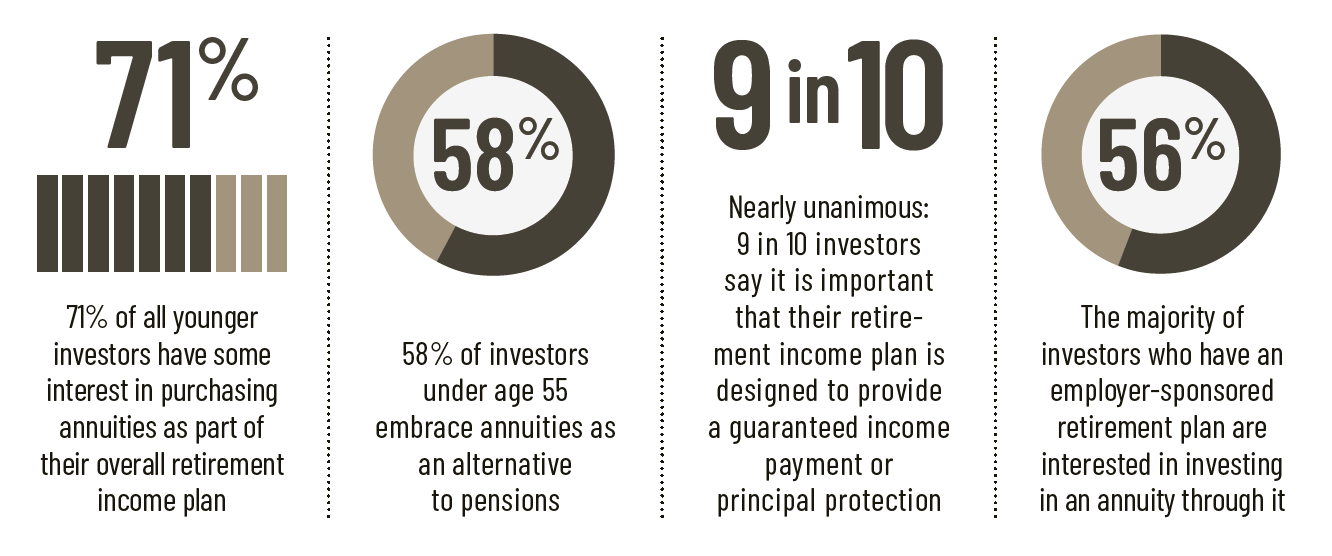

- 9 out of 10 investors are looking for protected income in retirement, saying it is important that their retirement income plan is designed to provide a guaranteed income payment or principal protection

- 58% of investors under age 55 embrace annuities as an alternative to pensions, considerably more than their boomer counterparts

- 71% of younger investors have an interest in purchasing annuities as part of their overall retirement income plan

- Gen Xers are three times more likely than boomers to express extreme interest in purchasing an annuity as part of their retirement income plan

For this study, we surveyed 1,519 investors ages 45–75 with a minimum of $100,000 in investable assets, between April 1–13, 2021. One third (34%) of the sample is retired (either fully retired or retired, but working part-time).

We also surveyed 602 financial professionals between March 23 and April 12, 2021. The sample includes reportable segments of registered investment advisors, independent broker-dealers, national wirehouse or full-service broker-dealers, regional broker-dealers and insurance broker-dealers. Bank broker-dealers were included in the study but not broken out separately due to their small sample size.

Learn more at the landing page on ALI’s website. Dig further into how perspectives on protected income changed in 2020 here.