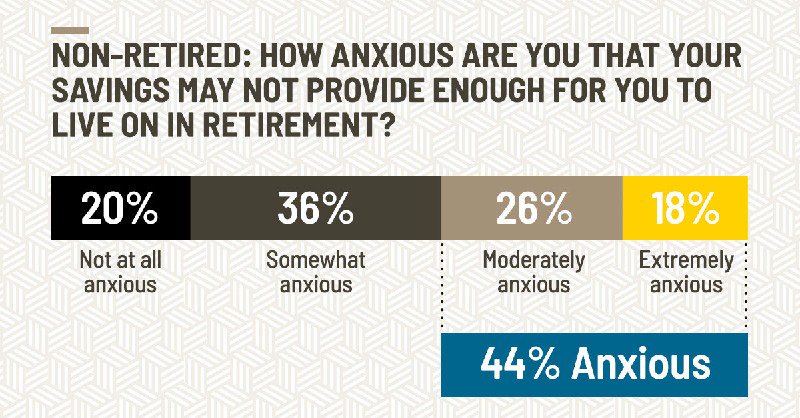

The majority of Americans are feeling retirement financial anxiety. According to a landmark survey of 3,119 U.S. adults that we conducted for the Alliance for Lifetime Income, eight in ten non-retired Americans (80%) express anxiety that their savings may not provide enough to live on in retirement.

Additional findings include the following:

- Americans are approaching retirement unprotected. Only 3 in 10 non-retired Americans (31%) have some protected retirement lifetime income (pension or annuity).

- The majority of non-retired Americans do not think their retirement savings and sources of income will last their lifetime. Two-thirds of Americans say they’re optimistic about retirement or the next phase in life, but only 42% of non-retired Americans believe their savings and sources of income will last their lifetime. Conversely, 71 percent of retired Americans believe their savings and income will last their lifetime – evidence in part that many of today’s retirees are among the last to benefit from a pension.

- Many Americans are not actively planning for retirement. Among non-retired Americans, only 1 in 5 have very seriously envisioned life in retirement – a figure that does not vary much by age. Furthermore, 8 in 10 non-retirees lack a specific financial plan that they follow.

Learn more on the Alliance for Lifetime Income’s results webpage, which includes a PDF of the full study results as well as a robust fact sheet.