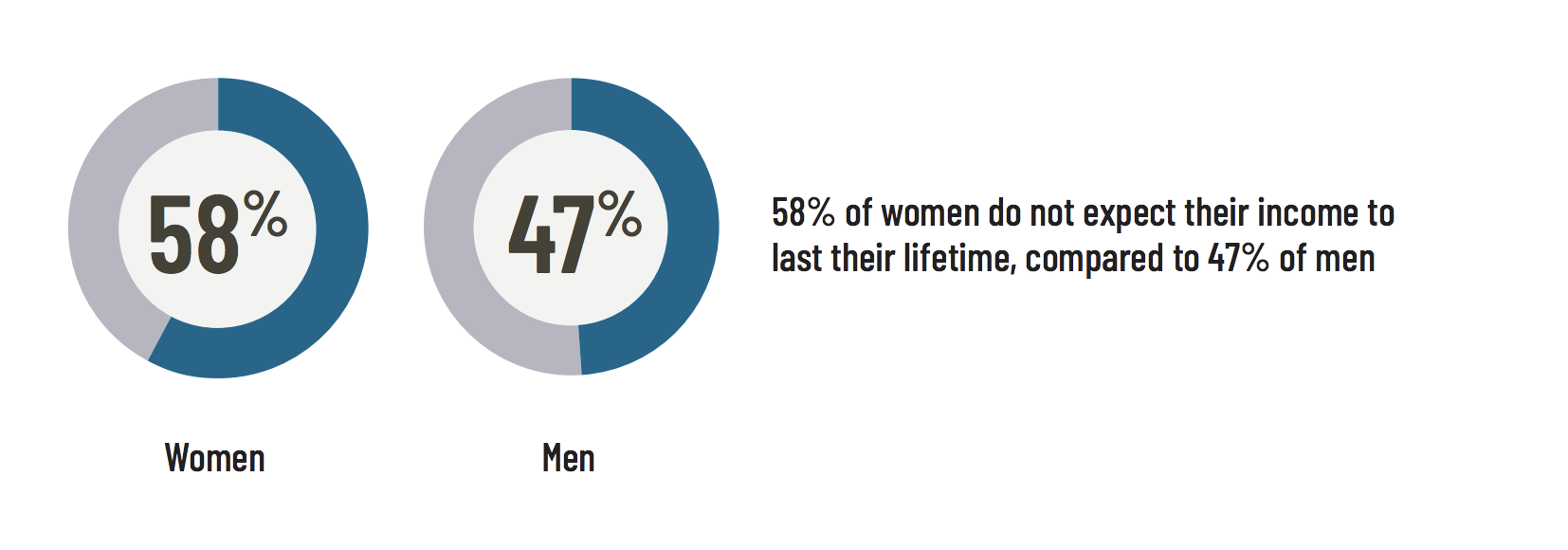

In our recent study for client the Alliance for Lifetime Income (ALI), we found that women are more concerned than men about outliving their money.

In fact, women lag men in several key indicators of retirement preparedness, including the following:

- Women are less likely to have a general financial plan for retirement than men (39% vs. 46%).

- Women are less likely to use professional financial advice; a mere one in four women (25%) actually have a professional advisor versus 32% of men.

- Other than Social Security, women are less likely to have an additional source of protected lifetime income than men (34% versus 41%). For non-retired women, the number declines to 28%.

Learn more by visiting the announcement on the Alliance for Lifetime Income website, which includes a detailed fact sheet [PDF]. Other recent insights from the research we conducted for ALI include that the majority of Americans are anxious about their financial preparedness in retirement. Stay tuned for more findings from the Census-balanced survey we conducted.