We conducted the sixth annual Protected Retirement Income and Planning [PRIP] Study with our partners at the Alliance for Lifetime Income (ALI) this year. The second chapter of the 2024 results were just released.

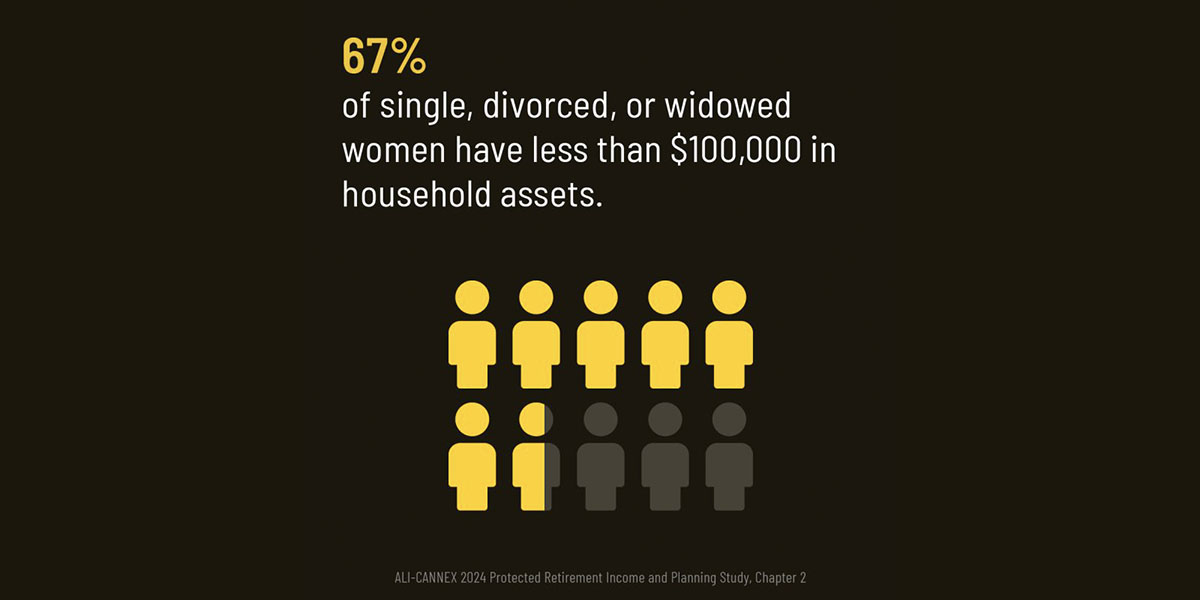

The gender divide is real and has a significant role in the retirement crisis. These stats in particular are alarming:

- Half (51%) of Peak 65 Women have less than $100k in assets.

- Among the over four out of 10 (42%) women who are single, over two-thirds (67%) have less than $100k in assets.

PRIP examines the attitudes and behaviors toward retirement savings of Americans ages 61 to 65, known as Peak 65 consumers. It is the only research of its kind that simultaneously surveys both consumers and financial advisors.

Asset Protection

Further insights, related to asset protection for women reaching retirement age, include the following:

- Women are more likely than men to say “protection” is very important to them when planning for retirement (76%) compared to men (67%).

- Peak 65 women who work with a financial professional are more interested in asset protection than men. Over 9 in 10 (92%) of Peak 65 women say it is “very important” that financial advisors identify ways to protect their assets. This is compared to 82% of Peak 65 men.

- 48% of women are worried about making complicated financial decisions due to potential cognitive decline compared to 36% of men.

Our take is that these smart Peak 65 women have enough life experience to understand the importance of protection. They just need to be made aware of how they can access retirement income protection. That’s where financial professionals come in.

Notably, this second chapter of the 2024 PRIP study aligns with findings from the Peak Boomers Economic Impact Study, a definitive economic study authored by Robert J. Shapiro, former Under Secretary of Commerce for Economic Affairs. This related study was released in April 2024 and commissioned by the Alliance’s Retirement Income Institute.

Learn more by downloading the report [PDF] or reviewing the press release on the study.

For summaries of previous PRIP chapters, see health concerns in retirement, retirement outlooks among Peak 65 women, annuities as a key retirement solution and chapter 1 of this year’s study, half of Peak 65 Zone Americans already retired.