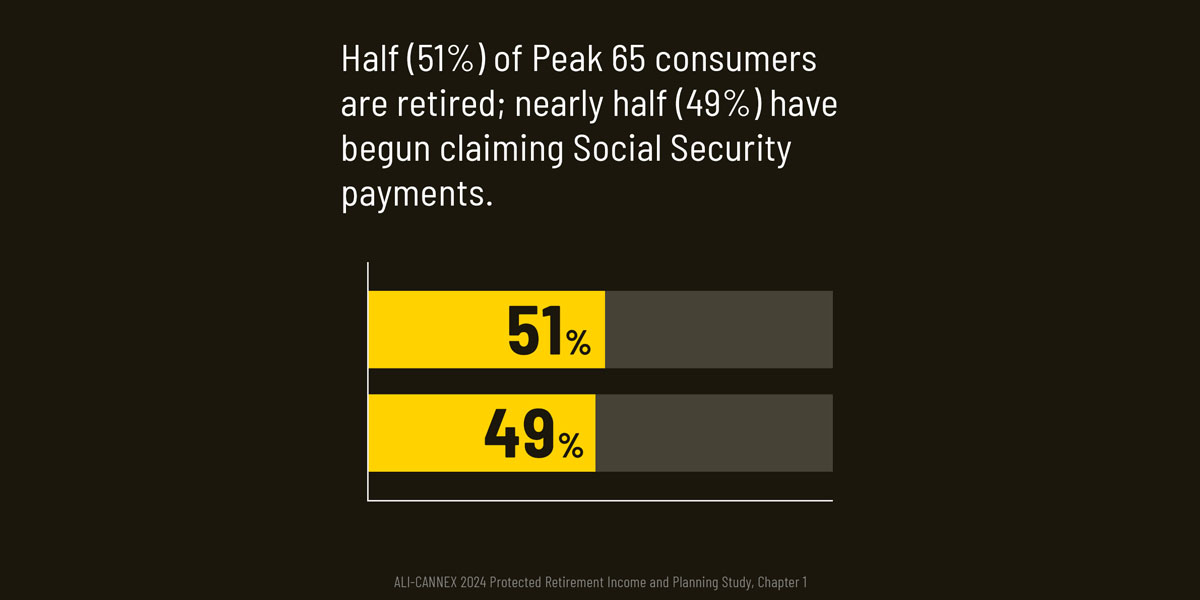

We conducted the sixth annual Protected Retirement Income and Planning [PRIP] Study with our partners at the Alliance for Lifetime Income (ALI), and the first chapter of the 2024 results were just released. They show stunning changes to the retirement landscape. Half of Americans ages 61 to 65 have already retired and started claiming Social Security payments. Additionally, 28% are still providing financial support to adult-age children and extended family members.

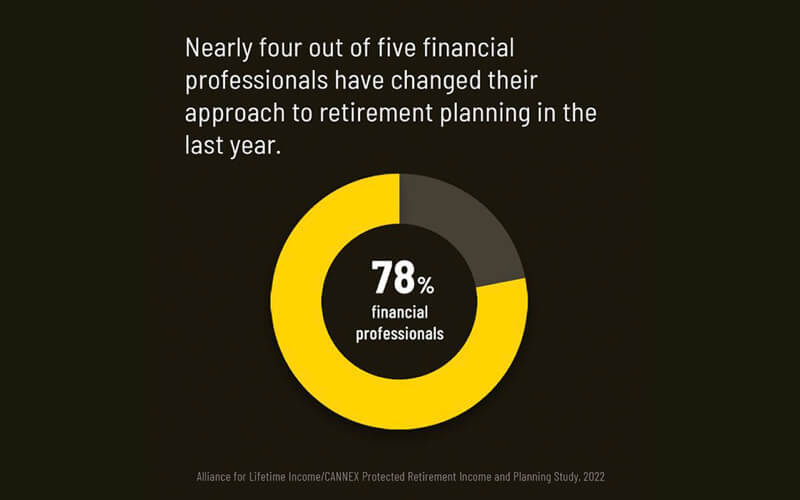

PRIP examines the attitudes and behaviors toward retirement savings of Americans ages 61 to 65, known as Peak 65 consumers. It is the only research of its kind that simultaneously surveys both consumers and financial advisors.

Further insights include the following:

- 66% of the Peak 65 consumers who are already receiving Social Security payments have investable household assets of less than $100,000.

- We found a seesaw of emotions when it comes to how Peak 65 consumers feel about retirement and money. While 34% are worried about their financial situation, an almost equal number (33%) are confident. And while 39% are uncertain about their financial situation, 42% are optimistic.

- Nearly half (48%) of Peak 65 consumers do not think their retirement savings and sources of income will last their lifetime.

While this survey confirms how emotionally uncertain and financially unprepared consumers are as they enter retirement, CEO of ALI Jean Statler points out, “The good news is millions of Peak 65 consumers still have the opportunity of protecting themselves from outliving their savings with an annuity.”

Learn more by downloading the report [PDF] or reviewing the press release on the study.

For summaries of previous PRIP chapters, see health concerns in retirement, retirement outlooks among Peak 65 women and annuities as a key retirement solution.