We conducted the sixth annual Protected Retirement Income and Planning [PRIP] Study with our partners at the Alliance for Lifetime Income (ALI) this year. The third chapter of the 2024 results were just released.

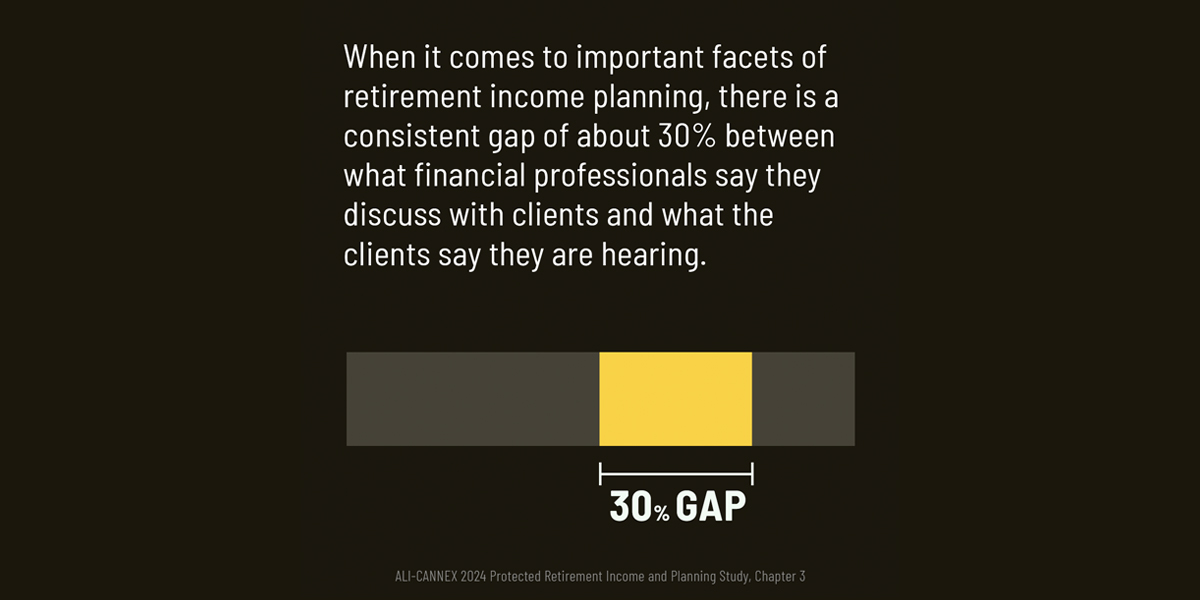

Unfortunately, this new study highlights key gaps in retirement planning conversations, including critical misunderstandings on protected income, annuities, long-term care, and social security awareness.

Specific disconnects include the following:

- While 62% of financial professionals say they initiate the topic of protected income with their clients, only 27% of investors agree. Nearly 100% of investors believe protecting retirement assets is important, compared to just 79% of FPs. There’s clearly a misaligning in terms of both priorities and how investors and FPs perceive these types of conversations.

- 96% of FPs say they discuss when clients should withdraw from certain accounts, but only 66% of clients say that is true.

- Almost six out of ten investors believe they may need independent living, assisted living, or nursing home care in the future, yet only 34% of FPs estimate their clients ages 45 and over think they will need such care at some point.

Investors and retirement professionals do agree on some topics of conversations: Both think of retirement as marking a new beginning rather than an end, and both groups also view retirement as a major milestone in life rather than just a continuation of their current lifestyle. This shared perspective provides a foundation for enhancing the retirement planning conversation.

Study Context

PRIP examines the attitudes and behaviors toward retirement savings of Americans ages 61 to 65, known as Peak 65 consumers. It is the only research of its kind that simultaneously surveys both consumers and financial advisors.

Learn more by downloading the report [PDF] or reviewing the press release on the study. An infographic is also available here [PDF].

For summaries of previous PRIP chapters, see health concerns in retirement, retirement outlooks among Peak 65 women, annuities as a key retirement solution. Chapter 1 of this year’s study found that half of Peak 65 Zone Americans already retired, while chapter 2 compared women vs. men in the Peak 65 Zone.