Our client the Alliance for Lifetime Income (ALI) recently published results from a nationwide survey focused on issues facing Americans approaching or in retirement. Because of the timing of this survey, conducted from June 18 to 22, many of these issues were specifically related to the COVID-19 pandemic. Overall, we found that COVID-19 and the subsequent market volatility are making Americans more pessimistic about their retirement plans and driving many to seek lower-risk options for their retirement investments.

The survey was conducted among a random sampling of adults ages 56 to 75 who are employed or retired, all with a minimum of $100,00 in assets.

Key takeaways include the following:

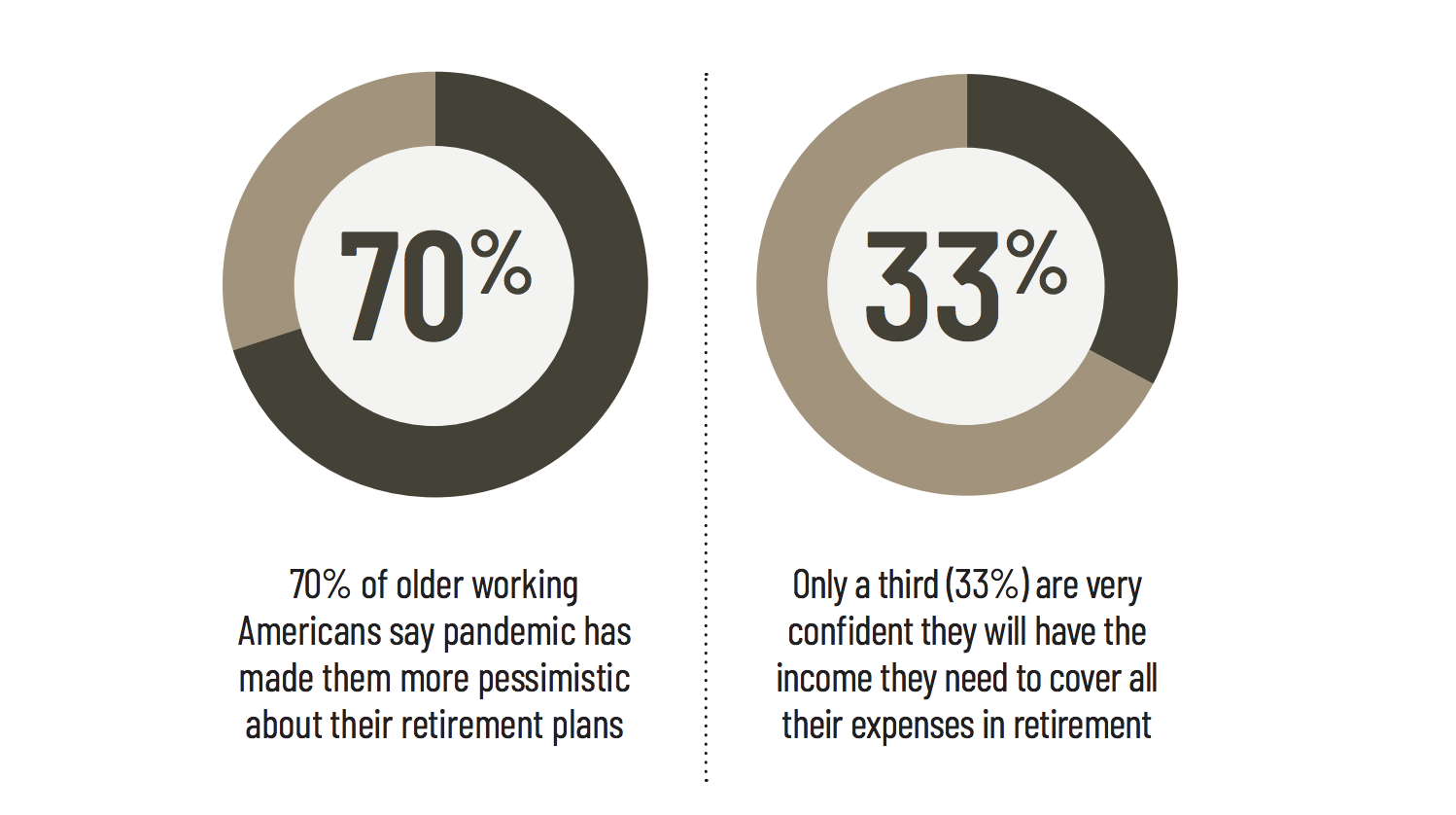

- 70% of older working Americans are more pessimistic about their retirement plans due to the pandemic.

- An estimated 3.2 million people have decided to retire later than originally planned.

- Almost 6 in 10 pre-retirees in the survey are reconsidering some aspect of their retirement plan, including how much money they’ll need in retirement.

Learn more about this study on the Protected Lifetime Income website, view the press release on the Alliance for Lifetime Income website, and explore the data in this PDF summary.

Two previous studies have been conducted by ALI during the pandemic, known as the COVID-19 Retirement Reset Trackers. The first, conducted in early to mid-March, assessed the impact of market volatility on retirement for those in their prime retirement years – ages 61 to 65. The second, conducted in April using a cohort with the same demographics as this third study, found that more older Americans are looking to reduce retirement risk due to the COVID-19 pandemic. For a refresher on the context during which this studies were fielded, please see the chart below.