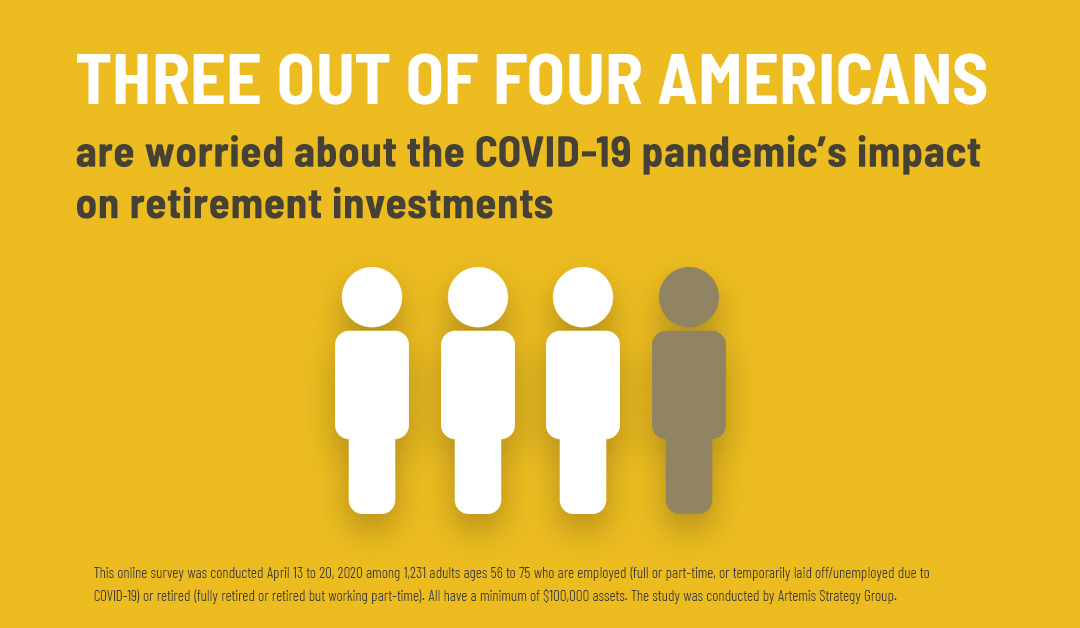

Our client the Alliance for Lifetime Income (ALI) recently published results from a nationwide survey focused on issues facing Americans approaching or in retirement. (This online survey was conducted April 13 to 20, 2020, among 1,231 adults ages 56 to 75 who are employed or retired, all with a minimum of $100,00 in assets.) The survey found that more older Americans are looking to reduce retirement risk due to the COVID-19 pandemic. They’re reconsidering risks in retirement portfolios and the importance of having a source of protected income in their plans to provide a level of certainty. This shift in risk tolerance is already driving long-term changes in retirement investing behavior.

Key takeaways include the following:

- One in four Americans surveyed say they have a lower risk tolerance for future retirement investments because of the COVID-19 pandemic.

- Losses in the stock market topped health care costs as the leading concern of those lacking confidence that their income will cover their expenses in retirement (75% vs. 60%).

- 22% of pre-retirees now expect to retire later than they originally planned to make up for recent investment losses.

- Only one-third are very confident they’ll have enough income to cover expenses in retirement.

Another study, published by ALI last month and conducted in early to mid-March, assessed the impact of market volatility on retirement for those in their prime retirement years – ages 61 to 65.

Learn more on the Protected Lifetime Income website, view the press release on the Alliance for Lifetime Income website, and explore the data in this PDF fact sheet.