In our recent study for client Global Atlantic, we asked investors how they expect the election cycle to impact their retirement plans.

Key findings include the following:

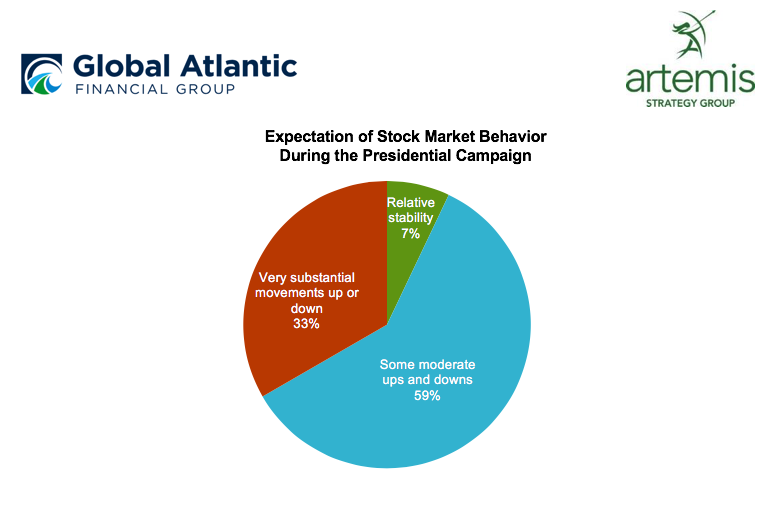

- A third (33%) of investors expect “very substantial” stock market volatility during the 2020 presidential campaign.

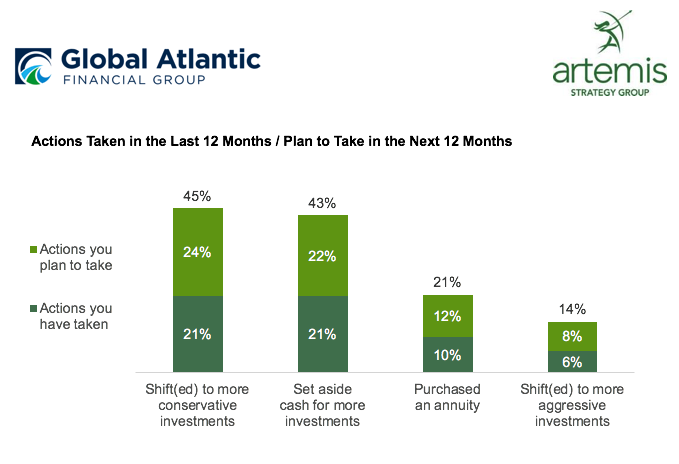

- Even amid the continued stock market rally, nearly half of respondents either already have (21%), or plan to (24%), shift to more conservative investments over the next 12 months.

- More than half of investors believe the winning political party will have an impact on their overall retirement strategy. Less than half of investors believe that the winning political party would have no impact on the future of their retirement.

Learn more by reading Global Atlantic’s public announcement.