Many Americans do not have protected retirement income.

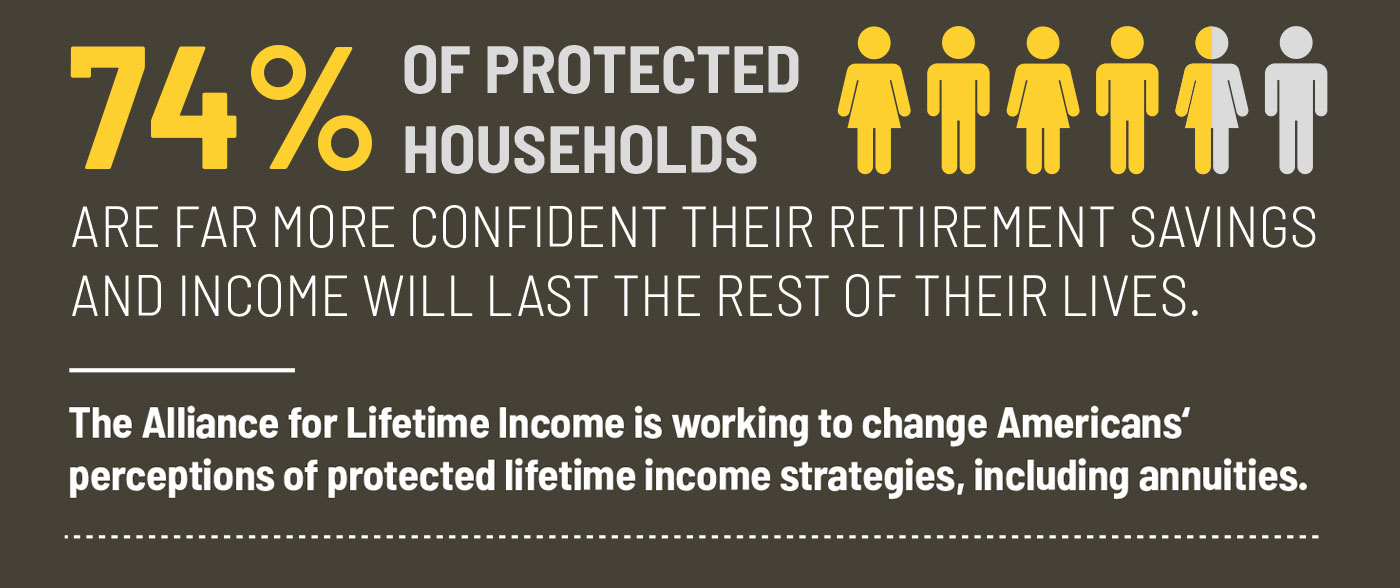

The Alliance for Lifetime Income recently published results of their inaugural Protected Lifetime Income Index. The findings, from research conducted by Artemis and our partners, highlight the urgent need for Americans to secure reliable lifetime income for retirement.

Key findings include the following:

- Two-thirds of today’s pre-retirees haven’t taken the critical step of calculating their expected retirement expenses.

- Half of retirees admit they did not determine their expenses before they retired.

- Only 38% of households have protected lifetime income in the form of an annuity or pension, leaving approximately 63 million households without protection.

- Retirees are nearly twice as likely as non-retirees to have protected lifetime income — 58% of retirees versus 32% of those not retired.

Learn more about the findings, as well as the first Protect Your Retirement Income Day on October 4 and the Alliance’s Research Fellows expert group, from the official press release. Visit the Alliance’s website to get acquainted with the nonprofit organization. Finally, consumers and financial advisors can find educational content and other resources about the new category of protected lifetime income at RetireYourRisk.org.